102019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Corporate tax rates for companies resident in Malaysia is 24.

Pdf Tax Non Compliance Amongst Individual Taxpayers In Malaysia

12018 TAX TREATMENT ON DIGITAL ADVERTISING PROVIDED BY A NON-RESIDENT.

. Objective The objective of this Public Ruling PR is to explain the - a special classes of income that are chargeable to tax under section 4A of the Income Tax Act 1967 ITA. WITHHOLDING TAX ON SPECIAL CLASSESS OF INCOME Public Ruling No. Or 212 Section 109B of the Act if the payment received is an income within.

Under the new rules both the monthly fees of 5 and 2 on overseas marketing will be subject to withholding tax. For example A engages B who is a foreign consultant to give consultation on a project and pays 100000. He is required to withhold tax on payments for services renderedtechnical advice.

Be used to calculate the WHT in Ringgit Malaysia. 10 December 2019 Page 4 of 42 The fees of RM2 85714 is subject to a withholding tax of 10 under section 109B of the ITA. Payer refers to an individualbody other than individual carrying on a business in Malaysia.

32017 on 7 December 2017 to clarify that the withholding tax exemption for offshore technical and installation services carried out by nonresidents has been restored for services performed outside Malaysia on or after 6 September 2017. Malaysia Taxation and Investment 2018 Updated April 2018 1 10 Investment climate 11 Business environment Malaysia is a federated constitutional monarchy with a bicameral federal parliament consisting of. 15 Tax incentives 16 Exchange controls 20 Setting up a business.

The tax withheld must be paid to the Internal Revenue Department IRD within 15 days from the date of withholding. WHT Dividends 1 Interest 2 Royalties 3a 3b Special classes of incomeRentals 4 5 Resident corporations. Any non-resident company receiving income from the use of or right to use software or the provision of services.

Under the existing rules only the monthly fees of 5 on the gross turnover is subject to 10 withholding tax while the 2 on overseas marketing is not subject to withholding tax as the service is not performed in Malaysia. Under the S109B Income Tax Act 1967 A would need to withhold 10 of that amount as withholding tax. Malaysia payment is subject to withholding tax under - 211 Section 109 Income Tax Act 1967 the Act if the payment received is a royalty income under the Act.

Withholding tax is an amount withheld by the resident carrying on business in Malaysia on income earned by a non-resident and paid to the Inland Revenue Board of Malaysia. Tax withheld from payments to residents and branches registered in Myanmar will be set off against the tax due on their final assessments. Withholding tax on any payment for the use of software to non-residents.

ABC Sdn Bhd is required to withhold RM10000 as tax to be paid to IRBM and JP Corp would be paid RM90000. 40 Withholding taxes 41 Dividends 42 Interest 43 Royalties. What is withholding tax in Malaysia.

Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900 24 400000 83650 25 600000 133650 26 1000000 237650 28 A qualified person defined who is a knowledge worker residing in. Services Rendered in Connection with the Use or Installation or Operation of. Malaysias Inland Revenue Board IRB issued Practice Note No.

Withholding Tax 6 March 2018 One World Hotel Petaling Jaya. September 2018 3 August 2018 2 July. With effect from 1 July 2018 the payment made by private businesses to a resident is.

Elin has been involved. WITHHOLDING TAX ON SPECIAL CLASSES OF INCOME Public Ruling No112018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Elins experience includes assisting clients with their corporate tax compliance matters in Malaysia and liaising regularly with the MIRB on various tax issues.

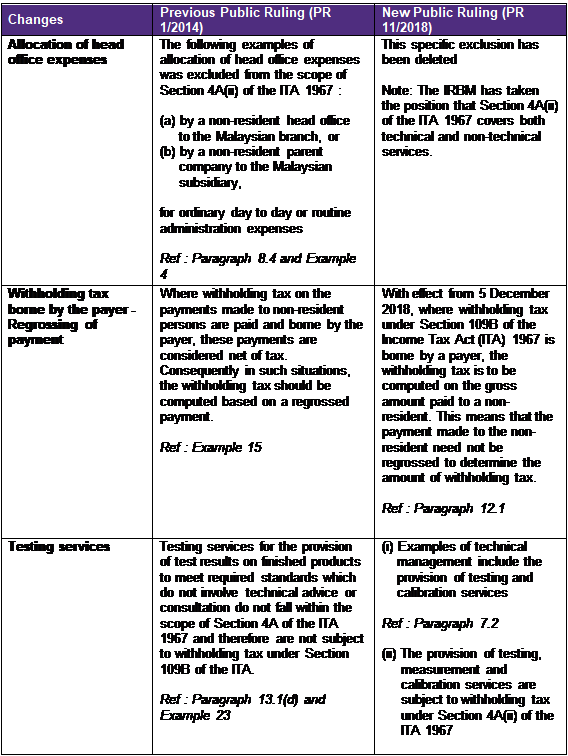

The IRB has issued Public Ruling 112018 - Withholding Tax on Special Classes of Income PR 112018 dated 5 December 2018 replacing the earlier Public Ruling 12014 - Withholding Tax on Special Classes of. 16 May 2018 WITHHOLDING TAX IN MALAYSIA. Withholding tax is an amount withheld by the party making payment payer on income earned by a non-resident payee and paid to the IRB.

Overview There are recent developments to the withholding tax regime in Malaysia. Withholding tax is an amount withheld by the party making payment payer on income earned by a non-resident payee and paid to the Inland Revenue Board of Malaysia. 112018 Withholding Tax on Special Classes of Income PR 112018 The Inland Revenue Board of Malaysia IRBM has uploaded on its website the PR 112018 issued on 5 December 2018 which supersedes the previous Public Ruling No.

The Malaysian Income Tax Act 1967 ITA 1967 provides that where a resident is liable to make payment as listed. As part of the deal JP Corp sent 3 engineers to Malaysia to assist in the installation of the machine and charged RM100000 for the installation services. 12014 Withholding Tax on Special Classes of Income last amended on 27 June 2018.

Accordingly offshore services carried out by nonresidents may be subject to. The Inland Revenue Board of Malaysia IRB has issued Practice Note 12018 TAX TREATMENT ON DIGITAL ADVERTISING PROVIDED BY A NON-RESIDENT on 16 March 2018. Withholding tax is applicable on payments for certain types of income derived by non-residents.

The Practice Note is to clarify that services particularly advertising services provided by a non-resident is subject to withholding tax under the following categories. Hotel Istana Kuala Lumpur MICPA CPD Hours. Affected business modelsin-scope activities.

20182019 Malaysian Tax Booklet 22 Rates of tax 1. The subsequent liability for TDS under section 195 of the Income Tax Act of 1961 in order to draft section 8733-8734 OF 2018. Revenue stream in scope.

What is subject to withholding tax in Malaysia2. Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share capital of MYR 25 million and below at the beginning of the basis period for a year of assessment. Withholding Tax Workshop Wednesday June 27 2018 One-day Workshop 900 am.

The installation fee of RM100000 is subject to 10 Malaysian withholding tax. A better understanding of the developments is crucial in complying with the withholding tax obligations and in. Quoting directly from the Inland Revenue Board of Malaysias official website withholding tax is an amount that is withheld by the party making payment payer on income earned by a non-resident payee and paid to the Inland Revenue Board of Malaysia IRBM.

5 December 2018 Page 1 of 39 1. Corporations making payments of the following types of income are required to withhold tax at the rates shown in the table below. Fx rate is based on rates published in the IRB or Bank Negara Malaysias.

See Note 5 for other sources of income subject to WHT.

Malaysia Achieves Record Direct Tax Collection Of Rm137b In 2018 The Edge Markets

Arena Multimedia Lahore Center 8 Days Adobe Photoshop Professional Course With Raheel Ahmed Baig On 7th Janua Arena Multimedia Network Marketing Solutions

St Partners Plt Chartered Accountants Malaysia Lhdn Public Ruling No 11 2018 Withholding Tax On Special Classes Of Income The Objective Of This Public Ruling Is To Explain The A Special

Media Resources Downloads Pembangunan Sumber Manusia Berhad Exemption Of Levy Order 2001 Kwsp 3rd Schedule 7 For Period Apr 2020 To December 2020 Gst Income Tax Forms Gst Forms Epf Kwsp Forms Socso Perkeso Forms News

Malaysia Achieves Record Direct Tax Collection Of Rm137b In 2018 The Edge Markets

Ini 7 Kebijakan Pajak Malaysia 2019

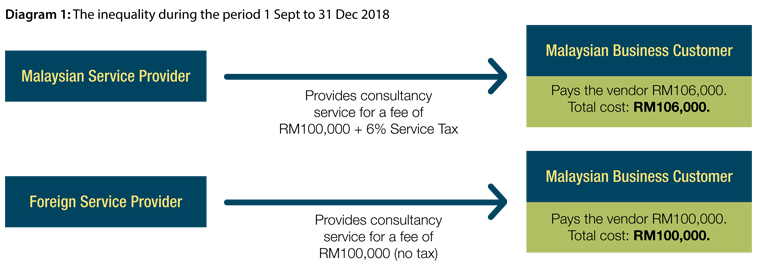

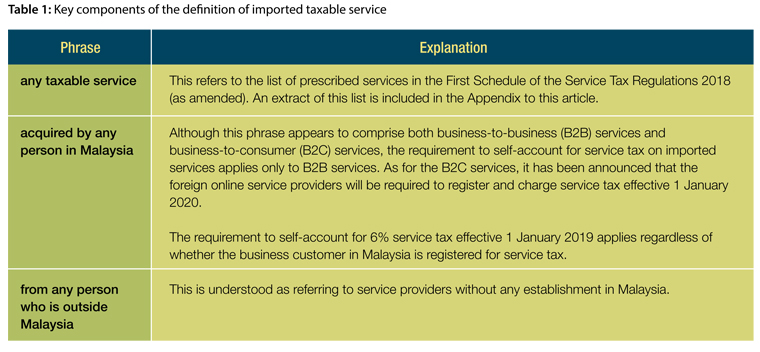

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today

Focus Malaysia Withholding Tax Changes A Headache For Firms Thannees

Malaysia 2018 Special Voluntary Disclosure Programme Conventus Law

6 Challenges Foreign Businesses Face When Doing Business In Indonesia Greenhouse Co

3rd International Conference On Business Management Icbm 2018 Pdf Performance Appraisal Job Satisfaction

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today

Laravel Training In Karachi 3d Educators Technology Systems Information Technology Development

Autocount Accounting Application Settings Software Update

Corporate Income Tax In Indonesia Acclime Indonesia

Tax Alert Grant Thornton Malaysia